JAKARTA – Banks around the world are reportedly using blockchain Ripple to improve the cross-border payment system. The efforts of the US Securities and Exchange Commission (SEC) to thwart XRP’s move to court did not affect Ripple’s reputation growth and expansion.

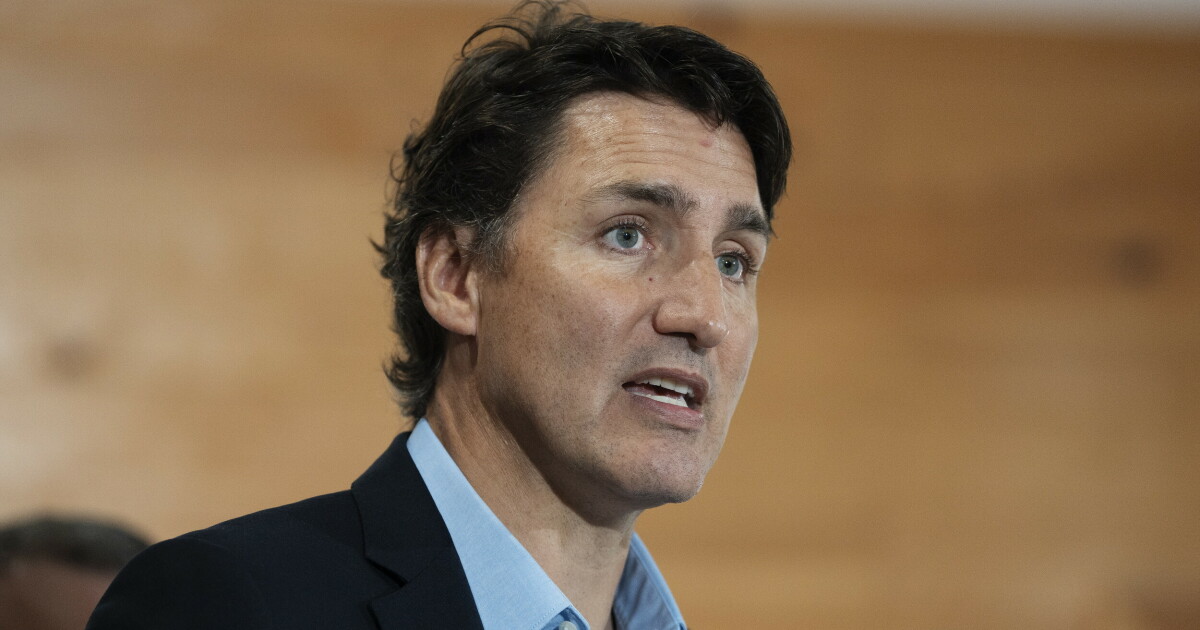

Recently, banks from Canada and Israel have signed a memorandum of understanding with the largest bank in the country of Kangaroo, National Australia Bank (NAB). This agreement is aimed at increasing the security and efficiency of cross-border payment systems, innovation strategies, and so on, as reported by BitcoinistMarch 22, 2022.

Various financial institutions in more than 55 countries around the world are reportedly using the Ripple payment network. Service Liquidity On Demand (ODL) they leverage the XRP crypto asset to “gain liquidity during cross-border transactions, as an alternative to traditional systems.”

The two Canadian and Israeli banks that signed the deal were the Canadian Imperial Bank of Commerce (CIBC) and Bank Leumi Israel. Now both use Ripple’s payment network for money transfer services between countries. This is the result of an agreement between the two banks in an alliance with NAB.

The Ripple network is used to improve customer experience and reduce costs, speed up financial transactions, and strengthen security systems.

The use of the Ripple network provides benefits to the banks concerned. This is evident from transactions that previously took up to two days, can now be completed in just a few minutes. Efficient transaction speeds are indeed needed by banks in the current digital era to strengthen consumer confidence in financial institutions.

“We believe that technology has the potential to not only provide international payments real time, but also improve the security and efficiency of our payment system. So this is an important part of the job,” said the National Australia Bank.

“We are delighted to be working with CIBC and to have partnered with them on the technology blockchain Ripple to complete our interbank international payment transfers as a proof of concept,” he added.

NAB Labs General Manager Jonathan Davey hopes the financial institution alliance will open the door for banks “to access first-class international innovation initiatives and insights.”

Davey also sees that this is an opportunity for financial institutions to develop joint solutions and utilize global knowledge and insights to “be at the forefront” in today’s era that demands fast-paced change.

On the other hand, the ongoing SEC and Ripple cases have had no effect on the growth of the XRP development company. In fact, Ripple’s growing reputation and partnerships with various international financial institutions are getting stronger.

In Australia, the Ripple network has become popular. Ripple’s prominence is recognized by various financial businesses that partner with state authorities when they develop regulatory frameworks relating to crypto assets.

Asheesh Birla as General Manager of RippleNet explained that the payment volume has reached more than 10 billion US dollars by the end of 2021. Ripple has also succeeded in expanding its On-Demand Liquidity (ODL) product to 22 destination markets. Birla states that ODL is almost global in scope.

He believes Ripple’s growth in reputation and rapid expansion is due to ODL’s ability to have high transaction speeds and be more efficient. This is considered to be a new solution for the current financial system.

“Aficionado Twitter ninja. Infuriatingly humble problem solver. Gets dropped a lot. Web geek. Bacon aficionado.”